2 years by Daniil Kolesnikov

Mastering the Finance niche in affiliate marketing: how lucrative is it?

What is this article about?

- Finance offers: what are they?

- Advantages of Finance offers

- 5 main challenges within the financial affiliate marketing

- Seize the moment: perfect timing for financial products

- Best GEOs for promoting Finances

- Targeting the ideal audience

- Best traffic sources for financial affiliate marketing

- Considering creatives that bring conversions

- Best Finance offers from Yellana

- Conclusion

One of the most dependable niches that is nearly completely unaffected by seasonality is the Finance sector. It offers large volumes, high rates, and the chance to consistently receive the ROI you were hoping for.

We at Yellana put great emphasis on affiliate marketing for financial products.

In this guide, you’ll learn how to monetize Finances, what obstacles you might face, as well as specifics on the types of offers, traffic sources, and traffic-generating strategies.

Finance offers: what are they?

Finance offers primarily come down to banking and payment systems that are prepared to pay for the issuance of new cards, creation of new bank accounts, loans, insurances, deposits on investment accounts, and MFO.

Types of Finance offers

Let’s examine the most prevalent categories of Finance offers and their general characteristics. They all work on CPA or CPL payment models.

- Bank cards (debit or credit)

Such offers call for a webmaster to provide leads that will submit an online form, issue a card at a bank branch, receive a card in the mail and activate it, or conduct their first financial transaction using a card.

Because not all cardholders can stay below the card limit, forget about their payments, and subsequently pay additional money to the bank, payouts on credit cards are often larger than those on debit cards. The longest holds are typically associated with offers that need bank cards since the advertiser requires more time to validate the lead. - Microfinance organizations (MFO)

They are private businesses that provide high-interest, fast loans. These deals work swiftly; it takes only about half an hour for the user to receive a microloan.

Despite having high interest rates, microloans are nonetheless popular because for some people, they are the only way to live honestly before receiving their next salary. Students, grown ups, and individuals who are prone to impulsive purchases are all interested in microloans.

With microloans, they typically pay webmasters for making a legitimate website request or for the microloan itself. - Investment accounts

The media buyer is compensated when a user opens a broker account with a particular bank, gets verified, and deposits money into it. Although more specific terms themselves depend on the offers and advertisers, they typically have the most challenging user flows.

The more steps your lead must take, the lower the likelihood of a conversion. Therefore, be very careful when selecting an offer and asking your manager if it would convert with your type of traffic. - Car loans, mortgages

These are the offerings that are most challenging for traffic. Loans for homes and cars typically involve large quantities of money and a down payment, therefore banks must check all applicants’ credit reports before approving.

Here, the CR is quite low, but the rates more than make up for it. With these offers, the hold is typically prolonged since banks take their time validating the lead.

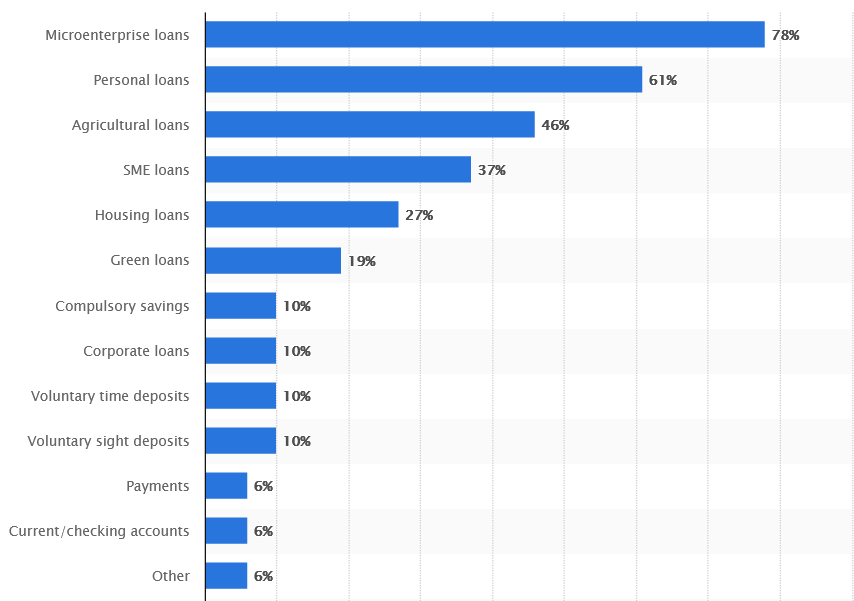

These are the main affiliate marketing financial services, but we want you to look over the graph below to get a better idea of what was popular in 2022 and what you should focus on right now.

Distribution of financial products and services offered by microcredit institutions in Europe in 2022 (Source: Statista)

Advantages of Finance offers

Despite being extremely competitive and requiring a certain set of skills from webmasters, the Finance niche is a gold mine that provides the following benefits:

- Big target audience

Which means wide targeting opportunities, a cheaper CPM, and more room for scaling the ad campaign; - High CR

The majority of the time, the offers come from well-known companies that have gained the public’s trust, indicating that the target market has already developed some allegiance to them; - High payouts

Rates range from $1 to $100 and higher depending on the target action; - Wide selection of target actions

You can work with issuing bank cards, filling out forms, gathering leads via a website form, and other target actions specified by the advertiser; - Stable ROI

If you work with white financial products, they help to predict advertising budgets and profitability. It is especially vital when you run high quality traffic.

5 main challenges within the financial affiliate marketing

The question that now arises is, what are the primary challenges a webmaster encounters when working with Finance offers? The key ones are as follows:

- Long hold

An average time frame for evaluating the traffic quality starts at two weeks and can reach three months; this is crucial if your testing budget is constrained.

However, if you build trust while working with Yellana through running high-quality traffic that we can inspect and make sure it meets our standards, you can get a shorter hold!

- Choosing an offer that suits you best

Finding an offer and the ideal target market for it can be very challenging. People who want insurance from the bank, for example, won’t be interested in making investments or deposits.

We’ll go through some of the top offers from the Yellana affiliate network later on in this article for you to check out. Additionally, you can get a Finance offer tailored to your needs by contacting your personal manager!

- Big profits demand patience

It is particularly pertinent for webmasters with limited resources. Long hold periods, as we’ve already discussed, as well as ROI that isn’t the highest on the market and improves with time following optimizations and larger budgets, all have an impact.

- Restrictions on traffic sources

It can be a difficulty because some of the offers have stringent restrictions on specific sources. As a result, you should think about having at least a few sources so you may switch between them and make the most of the offer you choose.

- Finding the perfect approach

It’s vital for reputable banks and financial institutions to regulate the creatives webmasters utilize because they value their reputation. Therefore, it’s crucial to provide your creatives the proper priority.

Seize the moment: perfect timing for financial products

Even though the Finance niche is evergreen, there are time frames when you can get the most of it!

Here are 3 tips from us:

- Spring is a good time for business loans since more new businesses are starting up and more people are investing in farms.

- Before seasonal sales, governmental or religious holidays (Black Friday, 11.11, New Year’s holidays, Easter, etc.), there is an upsurge in the demand for consumer loans and microloans.

- Credit cards are popular all year long, but there is a little increase before seasonal sales and during vacations (many travelers buy additional cards and insurance).

Now it’s time to talk about GEOs!

Best GEOs for promoting Finances

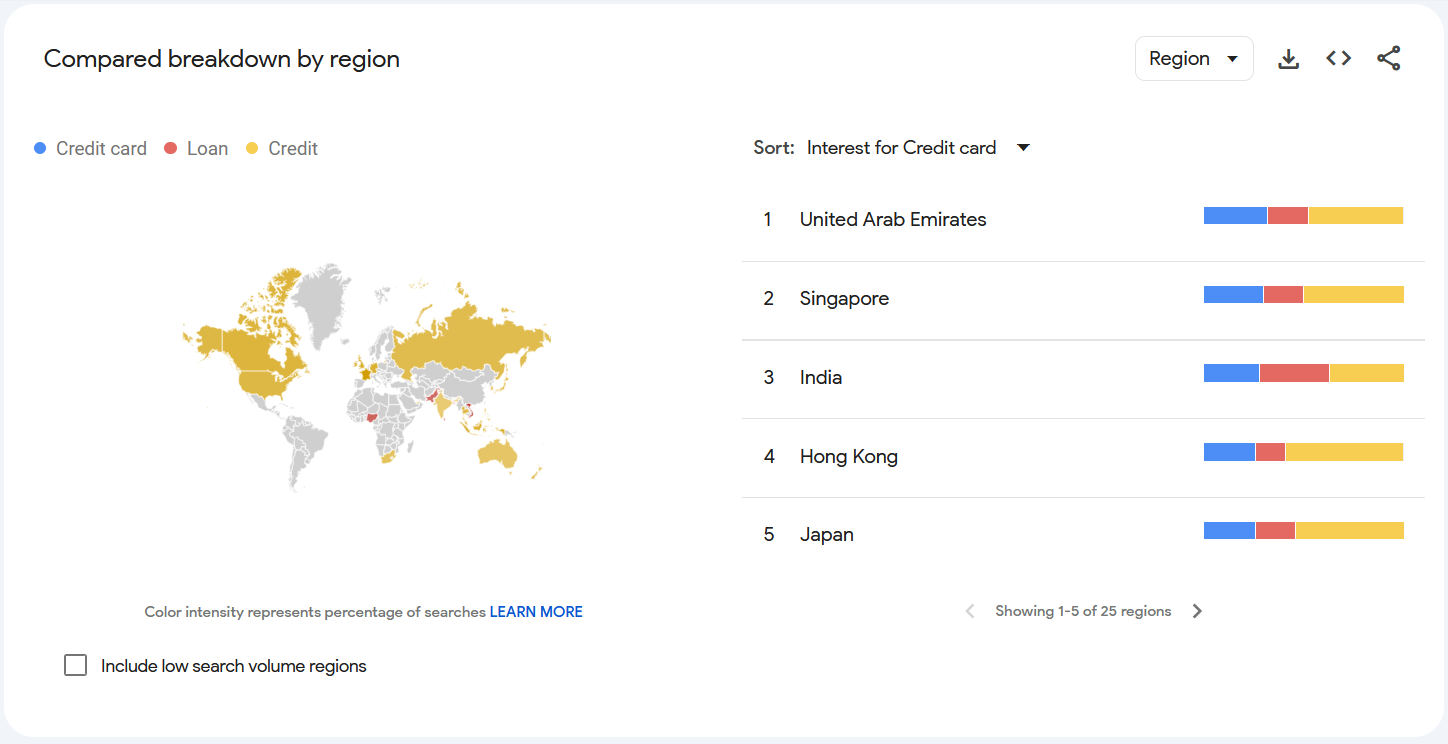

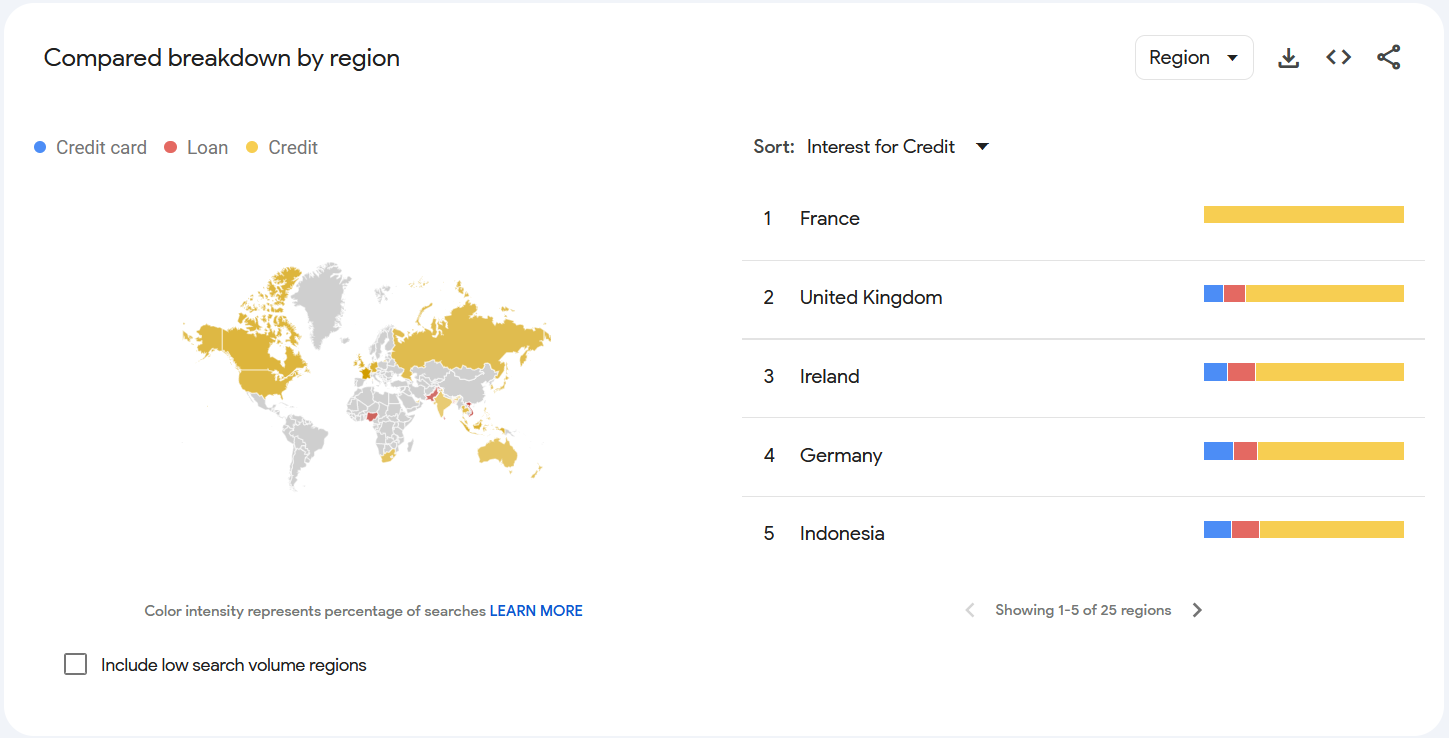

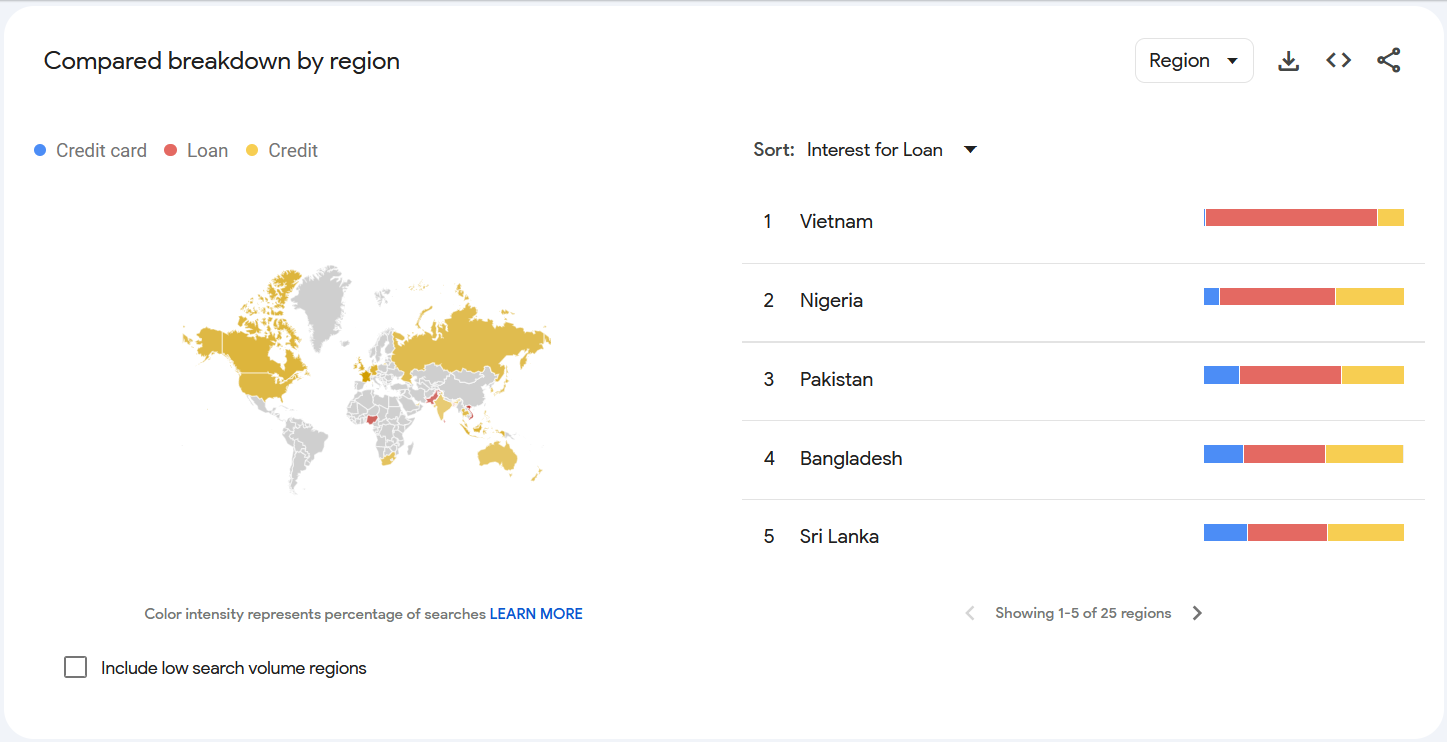

Although financial services are available in every country, not all of them offer credit cards or online loans. Google Trends shows that for the past 12 months (since September 2022) these nations are the ones where people are most likely to look for financial products:

- Credit cards

Credit cards are mostly popular in the UAE, Singapore, India, Hong Kong, Japan, Philippines, Sri Lanka, the US, Bangladesh and Canada.

- Credit

Credit is the theme widely popular in France, the UK, Ireland, Germany, Indonesia, Canada, the US, Hong Kong, Thailand and Russia.

- Loans

Loans are mostly common for GEOs like Vietnam, Nigeria, Pakistan, Bangladesh, Sri Lanka, South Africa, Philippines, Australia, New Zealand and India.

Targeting the ideal audience

You can see that different financial services are well-liked in different nations, and this is also true for the population you wish to target with your ads. Furthermore, poor targeting will result in a zero conversion rate rather than just a reduction.

What to do in order not to fall short?

Here are some tips for who to target:

- If you work with MFOs and banks, define the age range from 23 to 25 and 60 to 65 in order to lower the rejection rate.

- If you promote microloans, your primary target market will be those between the ages of 26 and 35 who have completed college or specialized secondary education and have a reliable source of income (and who urgently require cash till payday). Borrowers from microcredit organizations typically have incomes below the regional average and reside in smaller towns.

- You may fall into one of several categories if you advertise mortgages: military personnel between the ages of 35 and 45, young families, successful educated individuals with higher wages than the regional norm (aged 30 to 40), etc.

Since financial services are not arbitrarily chosen, wealth must be considered. Offering platinum cards or large-dollar loans to those with modest incomes or poor credit histories is useless since banks will turn them down, even if they are interested.

Best traffic sources for financial affiliate marketing

The following are the most popular traffic sources in the Finance vertical:

- Contextualized ads. Because individuals are already interested in credit cards, loans, and microloans, search ads are among the “hottest” advertisements. Only brand bidding is prohibited here;

- Email marketing. Probably one of the hardest channels to work with, however it provides the potential for higher ROI. The challenging aspect is gathering the database while avoiding the spam folder.

- Targeted ads. Such as those on Instagram, TikTok and other social media. Typically, they call for creatives to be approved.

- Storefront websites. They help visitors find the best price for them by compiling numerous offers from various banks or MFOs;

- SEO. Suits webmasters who have their own websites. It might be a financial news website or a blog that reviews new home appliances, for example.

Considering creatives that bring conversions

Beginner affiliates should pay close attention to this area because one of the biggest challenges within financial affiliate marketing is creatives. They must be of exceptional quality and inspire trust. Even the most careless people scrutinize everything carefully because it involves money.

- Among the classical approaches, you may use phrases that highlight special features or benefits like “Loan in 5 minutes”, “First loan without %”, “Credit card approved”, “Free cash-out of credit funds”, etc.

- Customers can also be drawn in by being encouraged to check their credit history. The creative itself suggests that you can receive a large loan for your demands because of your good credit score.

- Also, you may give the user an idea of where to spend money. For instance, if you have a website where you can read reviews on various home electronics, you can place a banner offering to purchase a smartphone or laptop by installment.

Another way to do this is to look through cooking forums, where you can gain amazing results from ads that encourage people to pay for a multicooker or other equipment in installments.

If you started an advertising campaign and it was profitable, don’t stop there; keep going. It shows results today, but something will change tomorrow and CR will decline. Analyze traffic and improve advertising to get the maximum ROI from each dollar spent.

Best Finance offers from Yellana

Now you are fully prepared to dive into the affiliate marketing financial services! Ready to rock it?

Check out offers the Yellana team has prepared right for you!

- Agora Investimento – BRA

GEO: BR

Paid event: registration

CPA: 4.8 USD

- Revolut Consumer Account – BRA

GEO: BR

Paid event: registration

CPA: 4.4 USD

- Sam’s Club – BRA

GEO: BR

Paid event: registration

CPA: 4.88 USD

If you want a personal offer from Yellana, we are here to help!

All you need to do is to register in our network and contact your personal affiliate manager who will pick the most profitable Finance offer on request specifically for you.

Conclusion

Although affiliate marketing for financial products doesn’t provide ROI in the hundreds or thousands of percent, the vertical has enormous potential. It has no seasonality, and the amount of microlending is just increasing.

With the right investments, you may make tens of thousands of dollars here without worrying that the vertical would vanish in a year. For webmasters who are prepared to make real money, this niche is perfect.

So if you are ready to make money today, join the Yellana team!